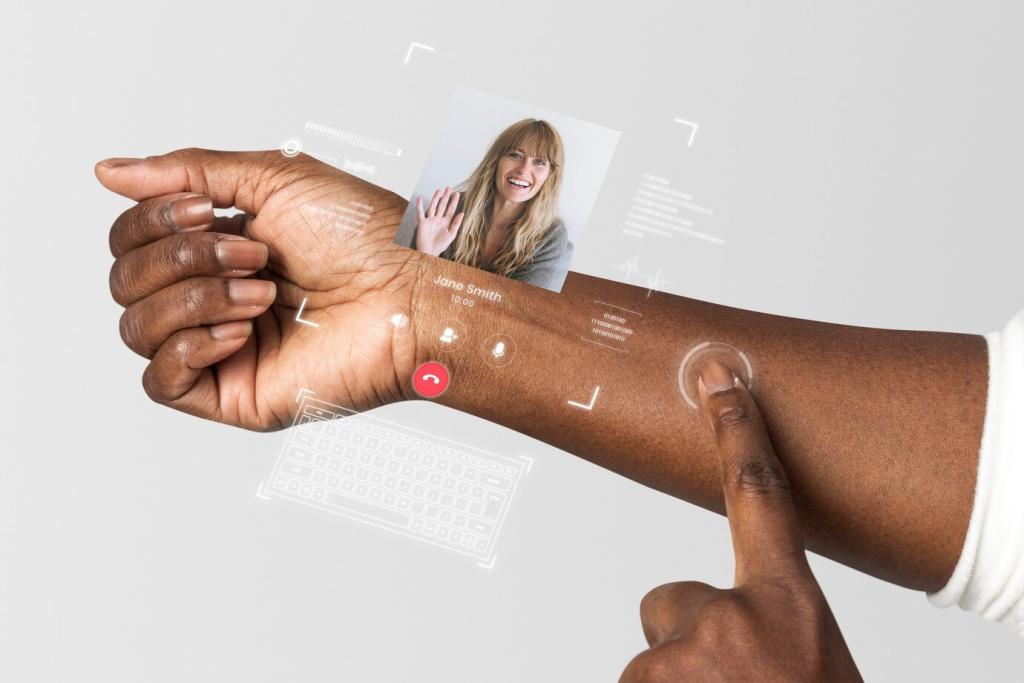

Your Money, Smarter: Personalized Financial Advice Through AI-Powered Solutions

Today’s chosen theme: Personalized Financial Advice Through AI-Powered Solutions. Discover how intelligent systems listen to your goals, learn your habits, and deliver guidance that feels handcrafted for your life—so you can move from financial noise to real, confident action.

From transaction histories to recurring bills and income patterns, AI identifies reliable signals, not noise. It maps seasonality, categorizes spending, and spots meaningful changes—then tailors suggestions you can actually use. Share your priorities in the comments to shape future guides.

Pattern-aware spending categories

AI tracks category drift—like groceries blending with takeout during busy weeks—and suggests smarter buckets that match your lifestyle. You’ll see where tiny leaks add up, and where a small tweak unlocks big breathing room. Comment with your trickiest category for tailored ideas.

Cash flow forecasts you can act on

By projecting paydays, bills, and irregular income, AI highlights the safest windows for purchases and transfers. It flags low-balance risk early and offers gentle course corrections. Subscribe for weekly forecast insights and step-by-step prompts to stay ahead of surprises.

Automated cushions for peace of mind

Smart rules sweep spare cash to savings after essentials are covered, then pause during tight weeks. You define comfort levels, the AI executes. Share your safety cushion target below, and we’ll send a guide to automate it with confidence.

Investing With Confidence, Guided by AI

Beyond a quick quiz, AI learns your comfort from behavior: do you sell during dips or keep buying? It calibrates exposure gradually, not abruptly, so your plan remains livable. Tell us your investing timeline to receive a personalized learning roadmap.

Data minimization and strong encryption

Responsible AI keeps only what it needs, encrypts data in transit and at rest, and separates identity from analytics. You can revoke access anytime. Comment if you want a walkthrough of permission scopes and how to audit them yourself.

Fairness checks and bias monitoring

Personalized financial advice must work for everyone. Regular bias audits, representative training data, and outcome testing help ensure equitable recommendations. Subscribe to learn how fairness metrics translate into everyday, inclusive guidance.

Human-in-the-loop for meaningful choices

AI proposes; you dispose. Critical actions include human confirmations, with clear trade-offs and alternatives. That balance keeps autonomy where it belongs—with you. Share a scenario you’d want human review on, and we’ll explore settings that fit.

A freelancer smooths volatile income

After months of feast-or-famine cash flow, AI suggested a rolling reserve target tied to three slowest months. Automated sweeps filled the buffer gradually. Comment “FREELANCE” and we’ll send you the exact template used for predictable peace.

A family hits their down payment goal early

Small adjustments—lower streaming tiers, bulk staples, and optimized credit rewards—compounded faster than expected. The AI kept morale high with milestone badges. Subscribe for our down-payment tracker and the micro-wins checklist that kept them motivated.

A near-retiree cuts investment costs

Fee analysis flagged overlapping funds. The AI proposed a simpler, lower-cost mix and a tax-aware transition plan. Annual fees dropped meaningfully. Ask for our fee-finder guide to uncover quiet costs hiding in plain sight.

Tools and Habits That Stick

The weekly money check-in

Fifteen minutes to review cash flow, upcoming bills, and goal progress. The AI preps a one-page snapshot with two suggested actions. Share your preferred check-in day, and we’ll send a printable template to make it effortless.

Preventing alert fatigue

Too many pings erode trust. Configure thresholds by category and silence non-urgent alerts overnight. AI prioritizes signals that deserve attention now. Comment “CALM” to get our alert hygiene guide and feel in control, not overwhelmed.

Accountability with friends or family

Private goal-sharing boosts follow-through. The AI creates neutral progress updates—no shaming, just support. Celebrate wins together. Subscribe for our accountability playbook and conversation starters that make money talks easier, kinder, and practical.

The Road Ahead for AI-Powered Advice

Expect clearer reason codes, short justifications, and side-by-side comparisons to help you choose. We’ll keep translating complexity into clarity. Tell us which topics confuse you most, and we’ll build a subscriber-only explainer series.

The Road Ahead for AI-Powered Advice

As integrations improve, your accounts sync faster and cleaner, reducing duplicates and categorization errors. That means sharper insights. Comment with tools you use now, and we’ll prioritize tutorials for seamless, secure connections.

Join our mailing list